The Bayer Securities Litigation concerns Bayer’s $63 billion acquisition of Monsanto, the agricultural behemoth that infamously became known as “the most hated company in the world” after it was repeatedly caught concealing the health risks of its major products. 710 Pension Fund as Lead Plaintiffs and Cohen Milstein Sellers & Toll PLLC as sole Lead Counsel for the proposed Class of investors.

On October 21, 2020, the Court appointed the Sheet Metal Workers National Pension Fund and the International Brotherhood of Teamsters Local No.On May 18, 2022, the Court denied Bayers motion to dismiss on liability.The decision creates strong precedent for other cases where plaintiffs allege that defendants have misrepresented the extent of their due diligence on an acquisition. The amended complaint therefore “alleges more than that the Monsanto deal was bad in hindsight instead, it alleges that the Defendants advanced in pursuit of the merger despite being aware that acquiring Monsanto brought significant risks, all while assuring investors they had fully assessed those risks themselves.” In addition, numerous analysts were critical of the merger at the time and shareholders doubted the merger so much they called for a vote on it. Further, Defendants had an opportunity to review additional information given that the Roundup litigation was already pending when the merger occurred and Monsanto had already produced internal documents in discovery. This included that Bayer CEO Werner Baumann had a longstanding focus on acquiring Monsanto despite its known reputational risks and also had a history of reckless due diligence practices. Plaintiffs adequately pled scienter-the requisite mental state-based on the numerous allegations alleged.Plaintiffs’ amended complaint sufficiently alleged that Defendants misled investors about the extent of Bayer’s due diligence on Monsanto’s legal risks, finding that Defendants’ statements about their due diligence could have misled investors by suggesting Bayer “had assessed Monsanto’s litigation risks, and had reviewed non-public information to inform that review,” but in reality, Defendants’ “diligence was less than what an investor would believe their statement meant.”.

On October 19, 2021, the Court denied in substantial part Defendants’ motion to dismiss, ruling that Plaintiffs adequately pled claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and SEC Rule 10b-5. Specifically, Judge Seeborg ruled:.710 Pension Fund, along with additional Plaintiff, the International Union of Operating Engineers Pension Fund of Eastern Pennsylvania and Delaware, as Class Representatives. The Court also appointed Cohen Milstein sole Class Counsel and appointed Cohen Milstein clients, Lead Plaintiffs Sheet Metal Workers’ National Pension Fund and the International Brotherhood of Teamsters Local No. Plaintiffs have therefore established the trades are domestic," said Chief Judge Seeborg. All of these acts occurred in the United States.

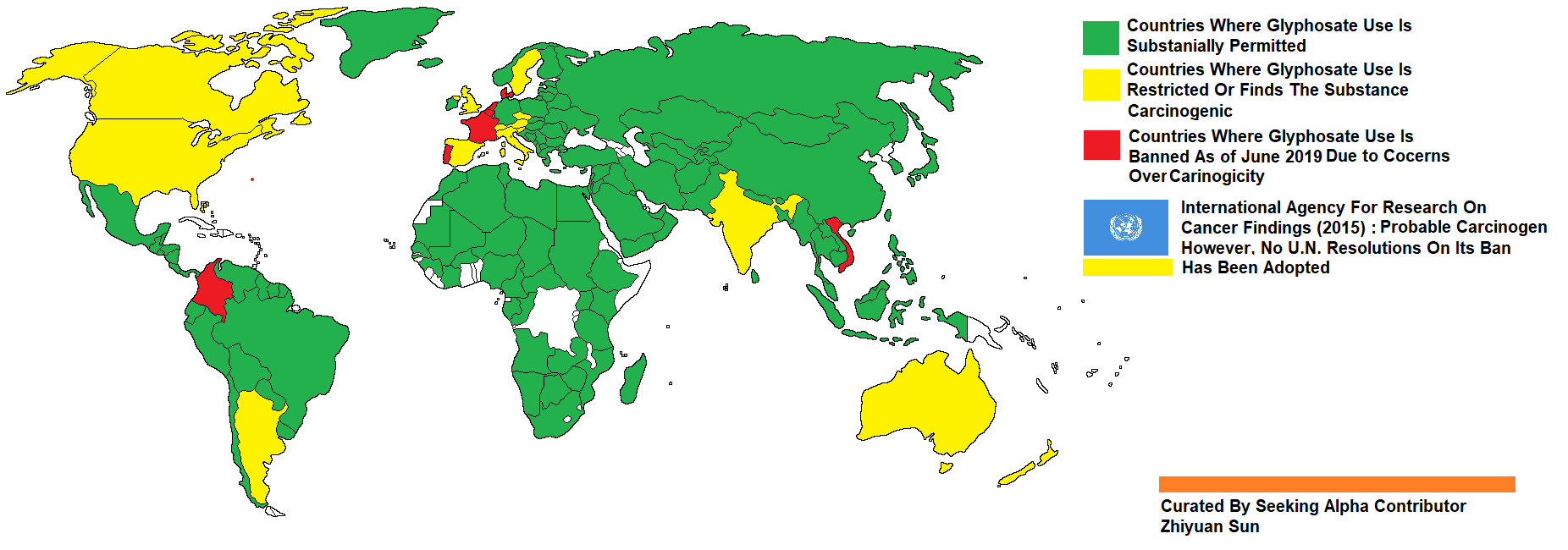

Relatedly, Plaintiffs have shown that title to the ADRs was transferred between BONY and one of the relevant broker-dealers, and, subsequently, from the broker-dealers to plaintiffs (via the investment managers). “Plaintiffs have shown that the seller of the ADRs (i.e., ) incurred irrevocable liability to deliver the securities once the broker-dealers deposited the Bayer shares they had acquired in Germany. Furthermore, the Court determined that Defendants had “an incorrect view of the irrevocable liability test.” and therefore did not raise extraterritoriality concerns, as required under Rule 23(a) and Rule 23(b)(3). In granting class certification, Chief Judge Seeborg determined that Plaintiffs’ American Depositary Receipt (ADR) transactions did not occur outside the U.S. Following the merger in 2018, Bayer sustained a barrage of major defeats in court related to a large toxic-tort dispute involving Roundup and was ultimately forced to establish a $10.9 billion settlement fund to address current and future Roundup claims. Plaintiffs claim that current and former Bayer executives, including Werner Baumann, Werner Wenning, Liam Condon, Johannes Dietsch, and Wolfgang Nickl (collectively, “Defendants”) made false and misleading statements to investors about the extent of their pre-merger due diligence on Monsanto’s litigation risks relating to its top-selling Roundup herbicide product.

BAYER AKTIENGESELLSCHAFT FULL

On May 19, 2023, the Honorable Richard Seeborg of the United States District Court for the Northern District of California granted class certification in full in this securities class action filed against Bayer Aktiengesellschaft under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and SEC Rule 10b-5.

0 kommentar(er)

0 kommentar(er)